Trusted by leading financial institutions around the world

Superior Card-Not-Present Fraud Protection

Outseer’s 3-D Secure data science uses unique consortium data from our Global Data Network while leveraging proven predictive AI-powered models resulting in superior performance with increased transaction approvals, reduced fraud, optimized challenge rates, and low false positive rates, translating to an 8-figure plus profit increases annually.

3-D Secure Access Control Server Powered by Superior Data Science

Protect your brand and cardholders from Card-Not-Present Fraud

Outseer (formerly RSA) 3-D Secure is an EMV® 3-D Secure Access Control Server (3DS ACS) that helps you ensure regulatory compliance and lowers total cost of ownership. Outseer 3-D Secure helps you increase transaction approvals and reduce fraud and operational costs associated with investigation and failed authentications, all while providing a secure and frictionless digital shopping experience for your cardholders.

Powered by the Outseer Platform, 3-D Secure sets the industry standard for card-not-present (CNP) fraud mitigation, aligning with the latest EMV® 3-D Secure protocol. Within the Platform, the Outseer Global Data Network feeds superior consortium data into our AI-powered Outseer Risk Engine, which uses insights from billions of transactions to create a predictive risk score. The risk score and related transaction are decisioned by our robust policy or rules manager, and all alerts are fed into our feature rich case manager. This all results in proven performance for unparalleled CNP fraud prevention.

Reduce your overall fraud by leveraging Outseer’s superior data science from confirmed fraud signals in the Outseer Global Data Network. These signals feed into Outseer’s Risk Engine, which orchestrates diverse data elements with effective predictive AI models trained on billions of CNP transactions to reduce unnecessary friction and overall fraud.

With fewer false alerts, there are fewer case investigations and customer inquiries, all leading to significant operational cost savings. Outseer’s superior data science has been proven in the largest banks in the world.

Increase approvals with more accurate data that reduces false declines and cart abandonment. With a 98% transaction approval success rate, Outseer’s data science 3‑D Secure consistently outperforms other market solutions while minimizing fraud losses. This leads to increased interchange revenues and greater cardholder loyalty.

With over 20 years’ experience working with EMVCo and card networks, Outseer can ensure timely updates to the EMV® 3-D Secure protocol as standards evolve so you can swiftly adapt to changing regulatory requirements at the global, regional or local level.

A set of capabilities that improve efficiency and puts you in control

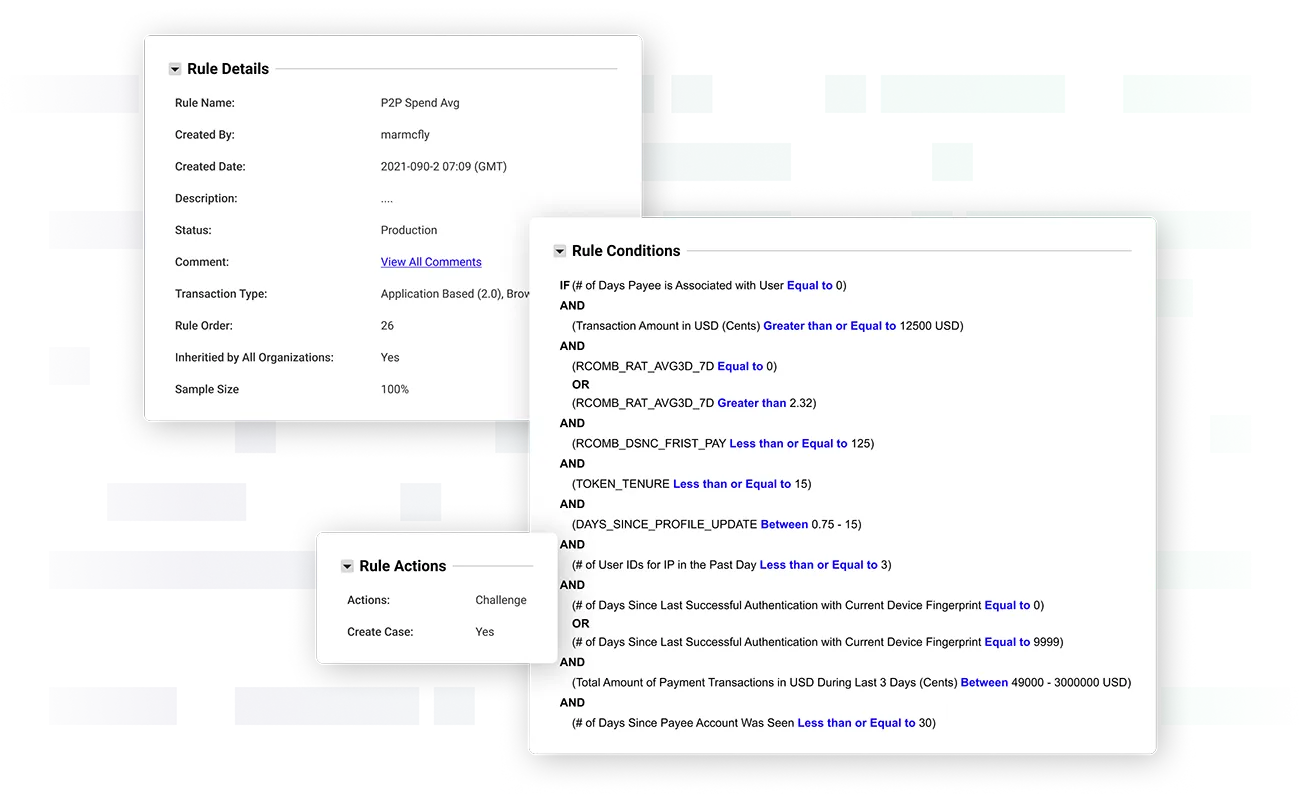

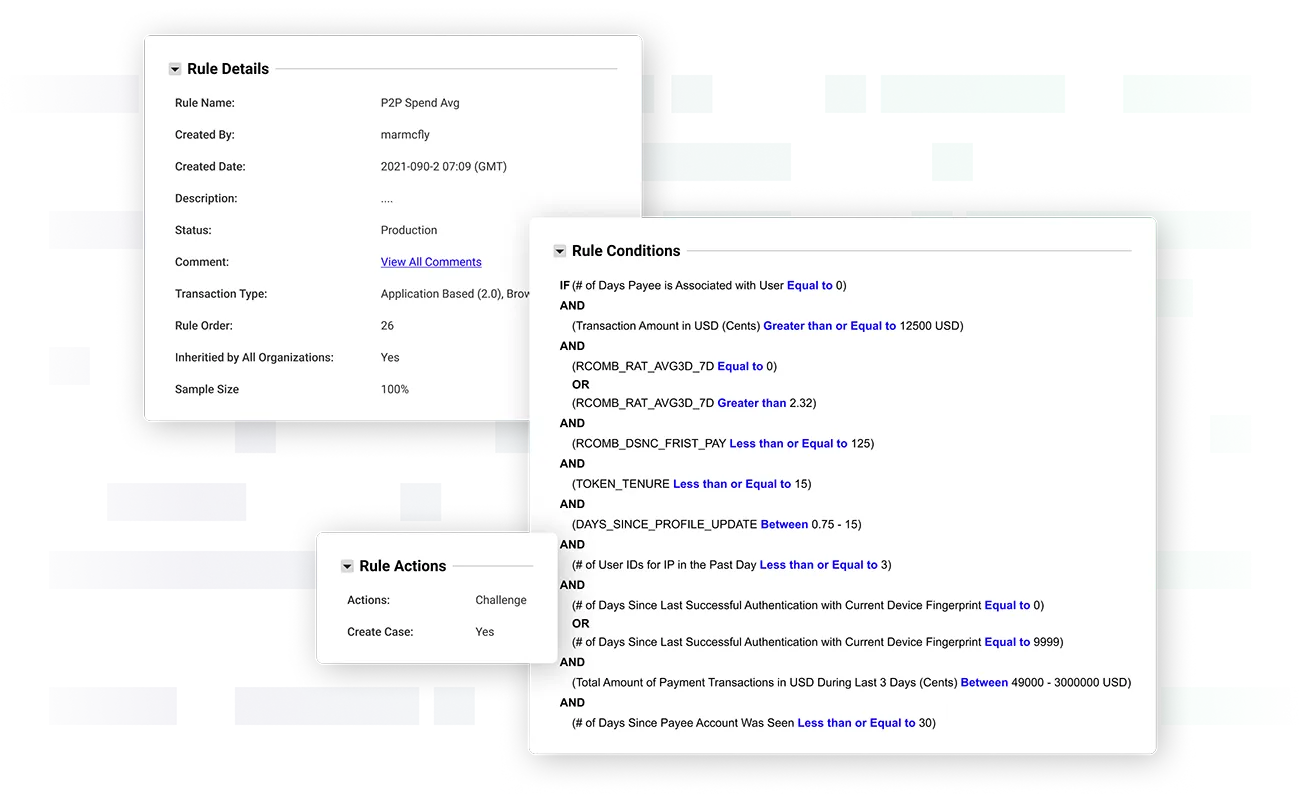

Create informed rules based on data and policies

The Outseer Policy Manager ingests the transactional data from our Global Data Network along with the orchestrated risk signals that are used to create an accurate risk score from our Risk Engine. It then applies the rules and policies set to render a decision to approve, decline, or challenge the transaction.

The Policy Manager provides the flexibility to easily define or modify rules and policies. You can manage the rules and lists to develop a set of tailored risk-management policies that meet your organization’s security requirements and risk tolerance, ensuring control and compliance with your desired outcomes and business objectives. For each policy, the rules dictate actions under the defined circumstances.

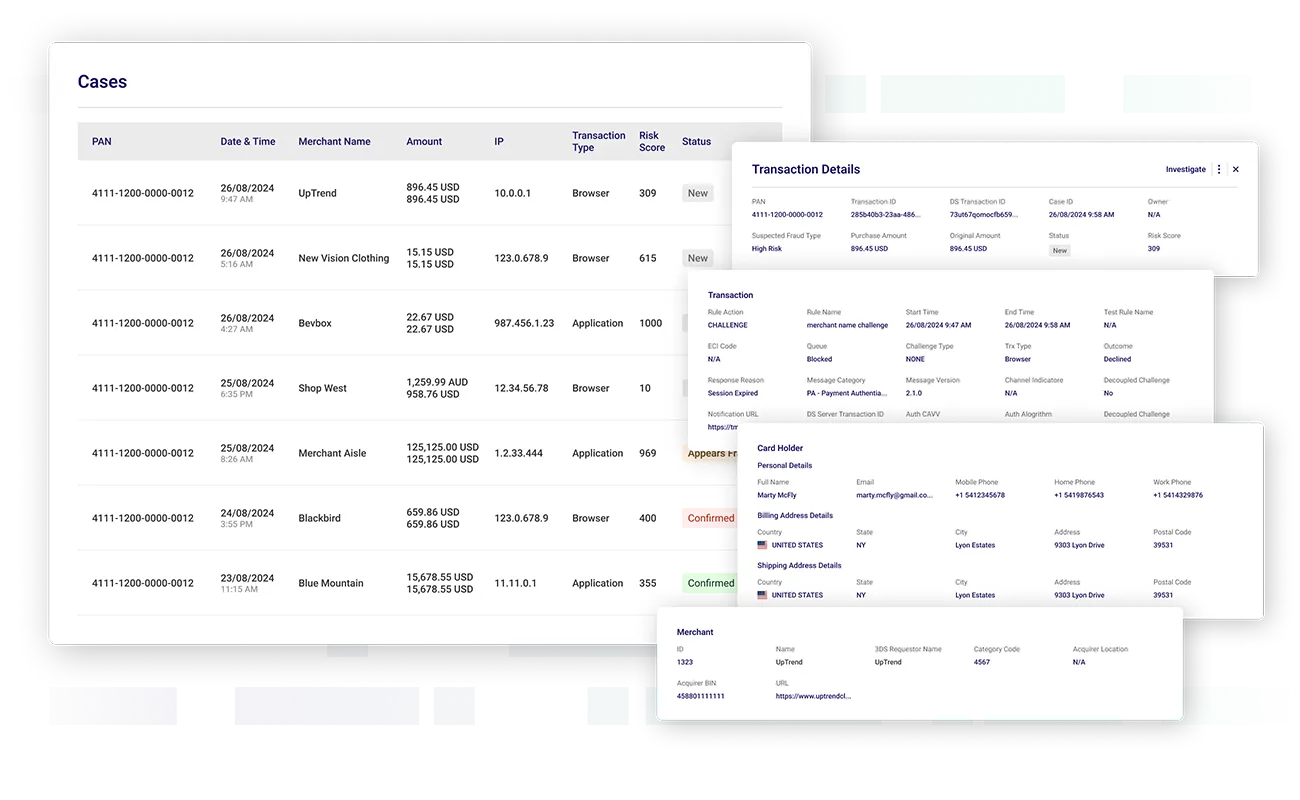

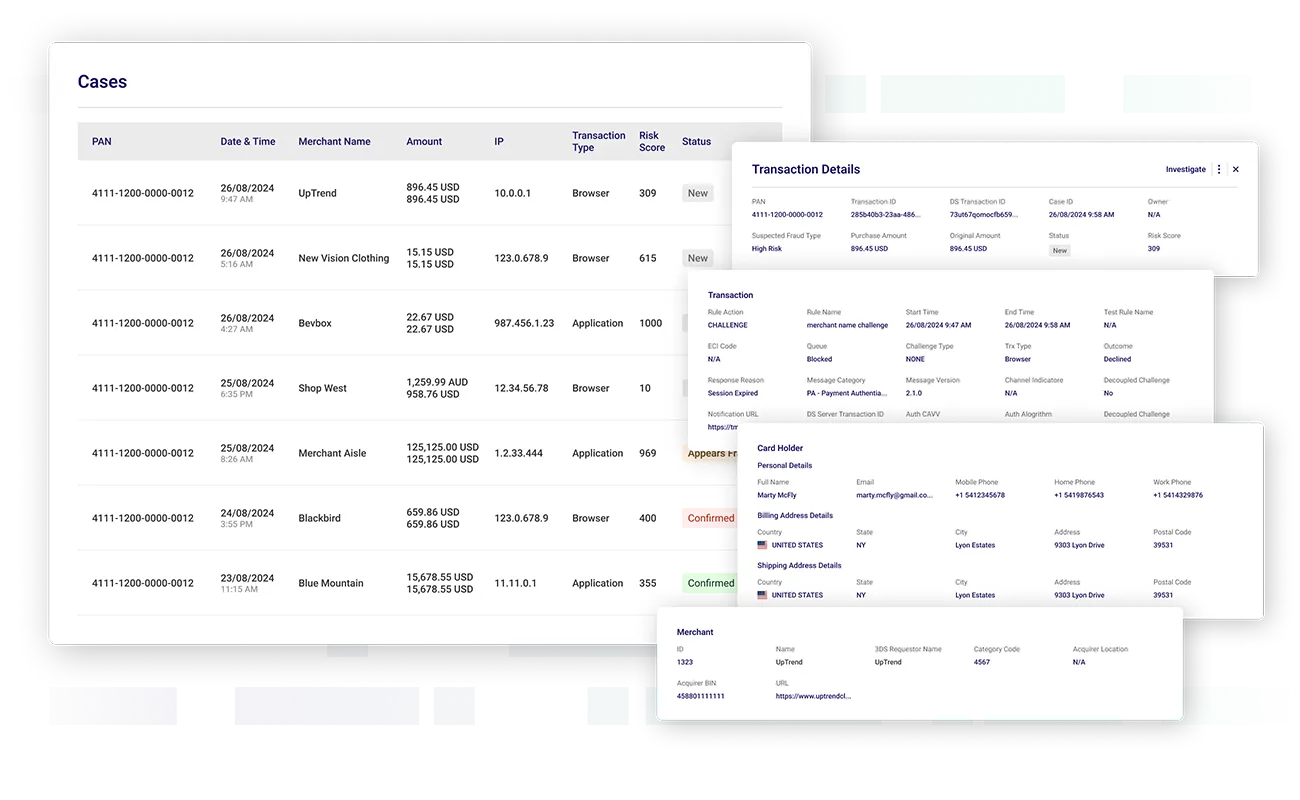

Drill down to better understand and confirm fraud events

Outseer Case Manager is a critical tool that helps you track, research, and manage potential fraud events according to the policies that are set. When a suspected fraudulent transaction occurs, a case is generated to provide details of the transaction for further investigation. Case management rules and policies can be put in place so that compromised cards can also be viewed as soon as a transaction fails so you do not need to wait for the cardholder to report and repudiate a fraudulent transaction. Fraud Analysts can then track the transactions that triggered a policy or rule to determine if the transaction is in fact fraudulent. They can also research cases and analyze attack vectors or fraud patterns. This knowledge can inform the creation of new policies or updates to current policies.

When cases reach final disposition, feedback is provided to the Outseer Risk Engine and Outseer Global Data Network, helping to enhance the risk analysis accuracy and lower false-positive rates by improving fraud prediction.

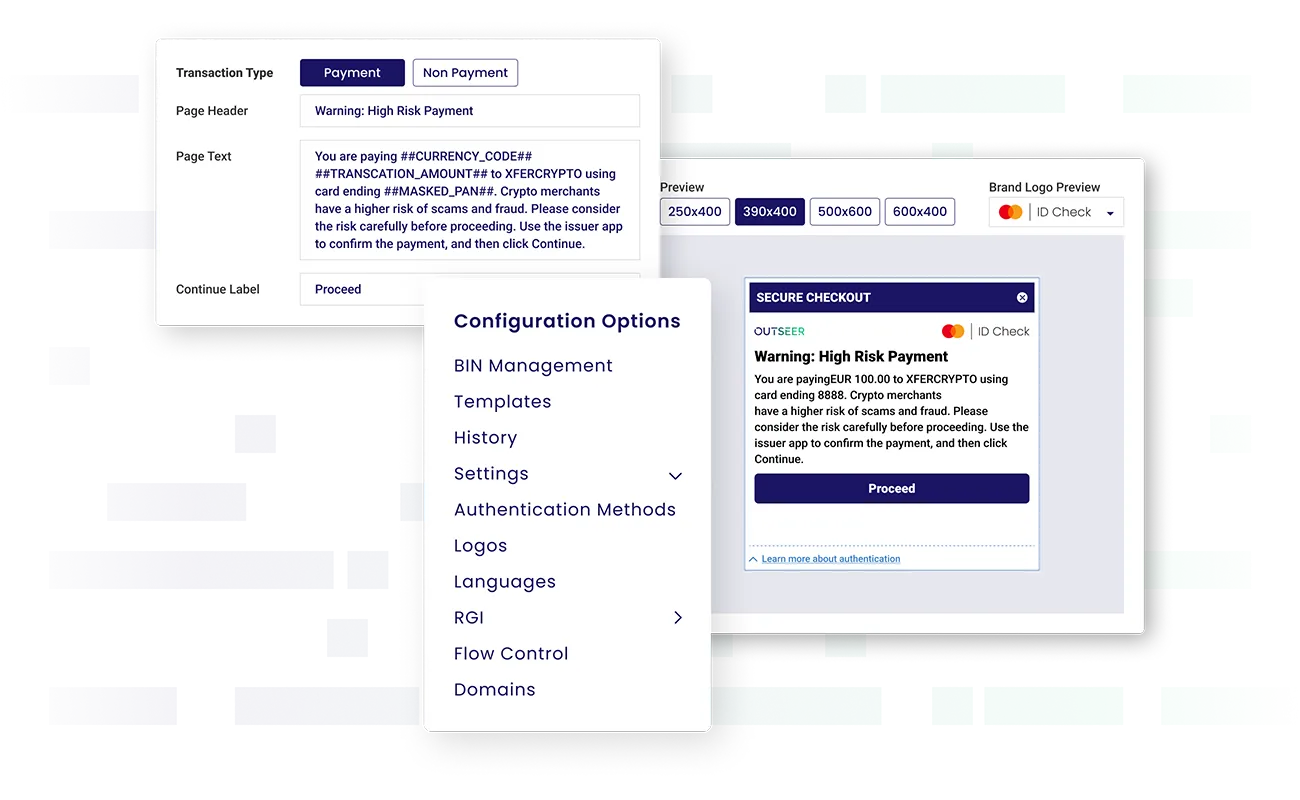

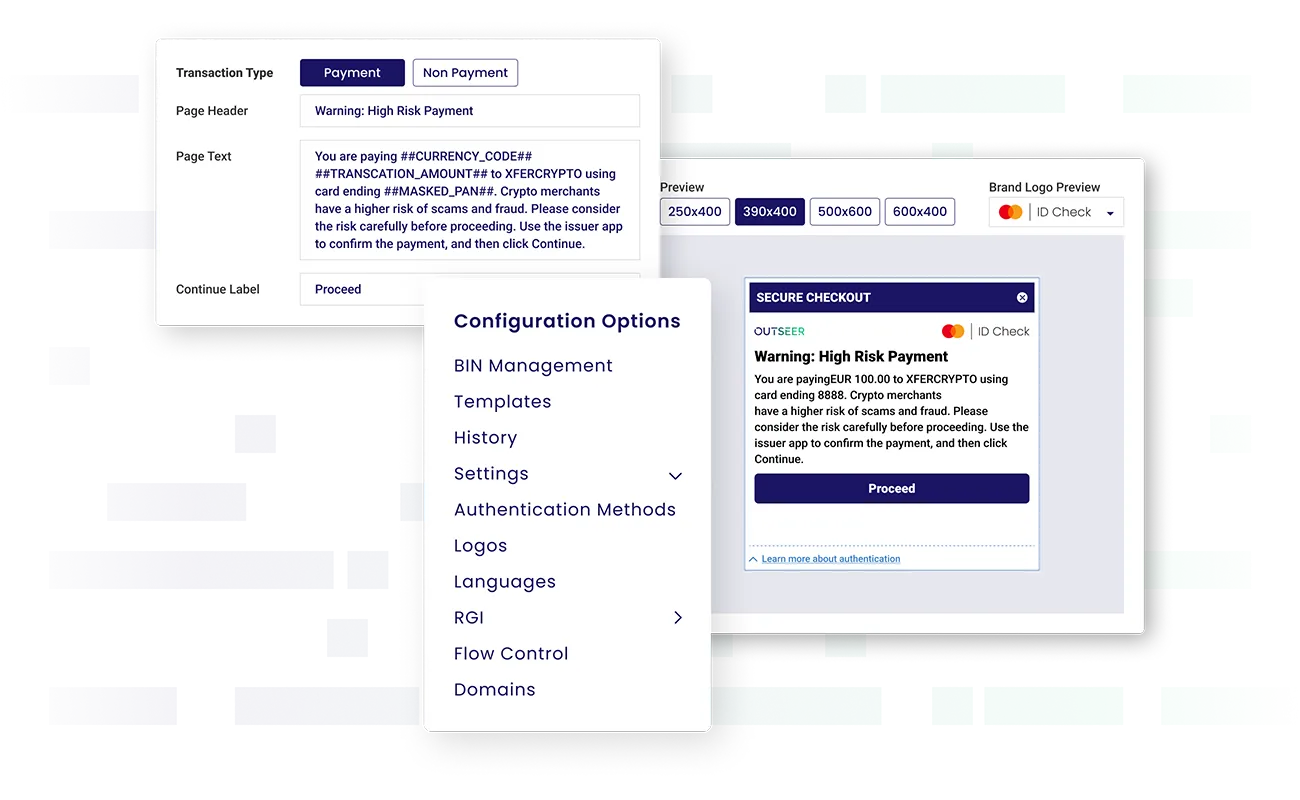

Optimize challenge flows and user interface, on your own timeline

With Outseer 3-D Secure Configuration Manager, you are empowered to manage and deploy your cardholder challenge flows. The intuitive interface allows you to view, edit and delete parameters that impact the look and feel of the challenge flow.

Issuers can maintain consistent branding across screens in up to 6 languages. You can also customize communication with personalized messaging aligned with specific rules such as threat policies or company branding, ensuring clarity and trust in every interaction.

This flexibility allows you to also tailor workflows based on transaction types so you can accommodate diverse payment methods such as recurring subscriptions, therefore reducing friction and enhancing user convenience. You can further define templates to customize card-holder challenge flows, such as cases where further user authentication is needed. A template is a collection of the defined customized fields, together with associated configuration settings. You can also define multiple templates or re-use the same ones.

Finally, you can minimize the time to deploy configuration changes by rolling out the changes on your own timeline, all without needing to engage a professional services team with the associated costs. This flexibility lowers your total cost of ownership and improves the versatility of your fraud operations.

Create informed rules based on data and policies

The Outseer Policy Manager ingests the transactional data from our Global Data Network along with the orchestrated risk signals that are used to create an accurate risk score from our Risk Engine. It then applies the rules and policies set to render a decision to approve, decline, or challenge the transaction.

The Policy Manager provides the flexibility to easily define or modify rules and policies. You can manage the rules and lists to develop a set of tailored risk-management policies that meet your organization’s security requirements and risk tolerance, ensuring control and compliance with your desired outcomes and business objectives. For each policy, the rules dictate actions under the defined circumstances.

Drill down to better understand and confirm fraud events

Outseer Case Manager is a critical tool that helps you track, research, and manage potential fraud events according to the policies that are set. When a suspected fraudulent transaction occurs, a case is generated to provide details of the transaction for further investigation. Case management rules and policies can be put in place so that compromised cards can also be viewed as soon as a transaction fails so you do not need to wait for the cardholder to report and repudiate a fraudulent transaction. Fraud Analysts can then track the transactions that triggered a policy or rule to determine if the transaction is in fact fraudulent. They can also research cases and analyze attack vectors or fraud patterns. This knowledge can inform the creation of new policies or updates to current policies.

When cases reach final disposition, feedback is provided to the Outseer Risk Engine and Outseer Global Data Network, helping to enhance the risk analysis accuracy and lower false-positive rates by improving fraud prediction.

Optimize challenge flows and user interface, on your own timeline

With Outseer 3-D Secure Configuration Manager, you are empowered to manage and deploy your cardholder challenge flows. The intuitive interface allows you to view, edit and delete parameters that impact the look and feel of the challenge flow.

Issuers can maintain consistent branding across screens in up to 6 languages. You can also customize communication with personalized messaging aligned with specific rules such as threat policies or company branding, ensuring clarity and trust in every interaction.

This flexibility allows you to also tailor workflows based on transaction types so you can accommodate diverse payment methods such as recurring subscriptions, therefore reducing friction and enhancing user convenience. You can further define templates to customize card-holder challenge flows, such as cases where further user authentication is needed. A template is a collection of the defined customized fields, together with associated configuration settings. You can also define multiple templates or re-use the same ones.

Finally, you can minimize the time to deploy configuration changes by rolling out the changes on your own timeline, all without needing to engage a professional services team with the associated costs. This flexibility lowers your total cost of ownership and improves the versatility of your fraud operations.

Superior Data Science and Technology

To protect your brand and cardholders from CNP fraud, Outseer 3-D Secure uses current, proven technologies and data science techniques.

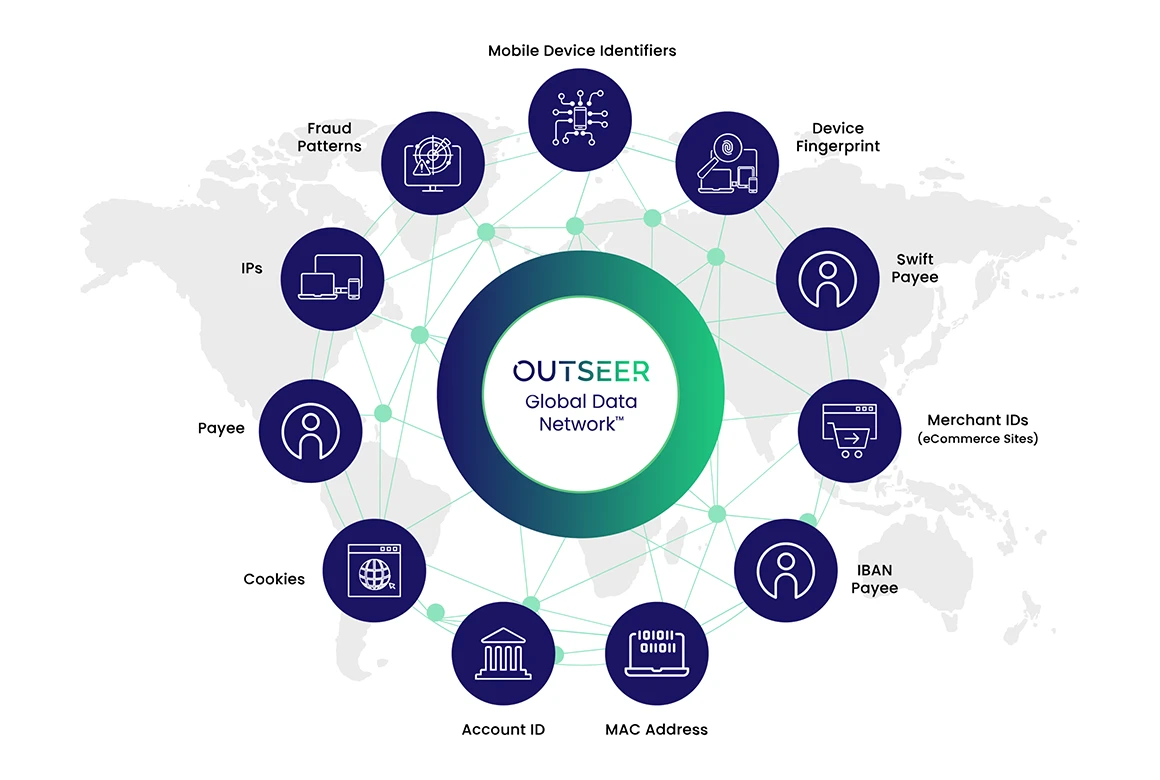

Global Data Network

The Outseer Global Data Network is a collaborative data consortium that aggregates confirmed fraud signals from millions of transactions across thousands of the largest financial institutions in over 50 countries, resulting in around 830k transactions flagged and significant potential fraud prevented daily. With near real-time sharing of high-quality signals from confirmed fraud events, it provides indicators into emerging threat patterns.

Outseer 3-D Secure safeguards CNP transactions by using the Global Data Network score to analyze a wide variety of signal intelligence fields such as:

- Mobile device identifiers

- Emails and domains

- Cookies

- IPs

- Geolocation

- Merchant IDs

- Device Fingerprint

- Fraud patterns

Purpose-Built Risk Engine with Normalized Scoring and Signal Orchestration

The Outseer Risk Engine and AI are purpose built for 3-D Secure to detect fraudulent activity, using superior data from our Global Data Network and well-tuned predictive AI models trained on billions of transactions. Our algorithms orchestrate and analyzes transaction data, consortium data signals from our Outseer Global Data Network, and first- and third-party signals, producing a highly accurate score that is normalized to optimize intervention rates so you only challenge customers when necessary and at a predictable rate.

This helps us deliver robust, transparent authentication and unparalleled fraud prevention that delivers a proven performance advantage over competitive solutions for both fraud prevention and transaction completion rates, preventing hundreds of millions of dollars of fraud annually.

The Risk Engine for 3-D Secure integrates and orchestrates diverse data elements such as:

- User behavior

- Behavorial biometrics

- Device information

- Transactional patterns

- Geolocation

- EMV 3DS protocol specifics

This helps us deliver robust, transparent authentication and unparalleled fraud prevention.

Fully featured platform supports layered fraud prevention

With high-risk transactions or those breaching policies, a step-up authentication is triggered. Our out-of-the-box step-up authentication options and flexible interface integrate with your organization’s authentication methods, including One-Time Password (OTP), token interface workflows, and Out of Band (OOB) interface workflows.

You can also provide a personalized and transparent cardholder experience with tailored authentication screens for different transaction types, including text to clarify the nature of the transaction.

The 3-D Secure API enables you to integrate your internal applications with 3-D Secure functionality and build a behind-the-scenes automation process between your internal systems and 3-D Secure, such as a central case manager for different applications. For example, you can use the Back Office API for actions such as retrieving transaction and case information, providing feedback on cases, and unlocking a blocked PAN.

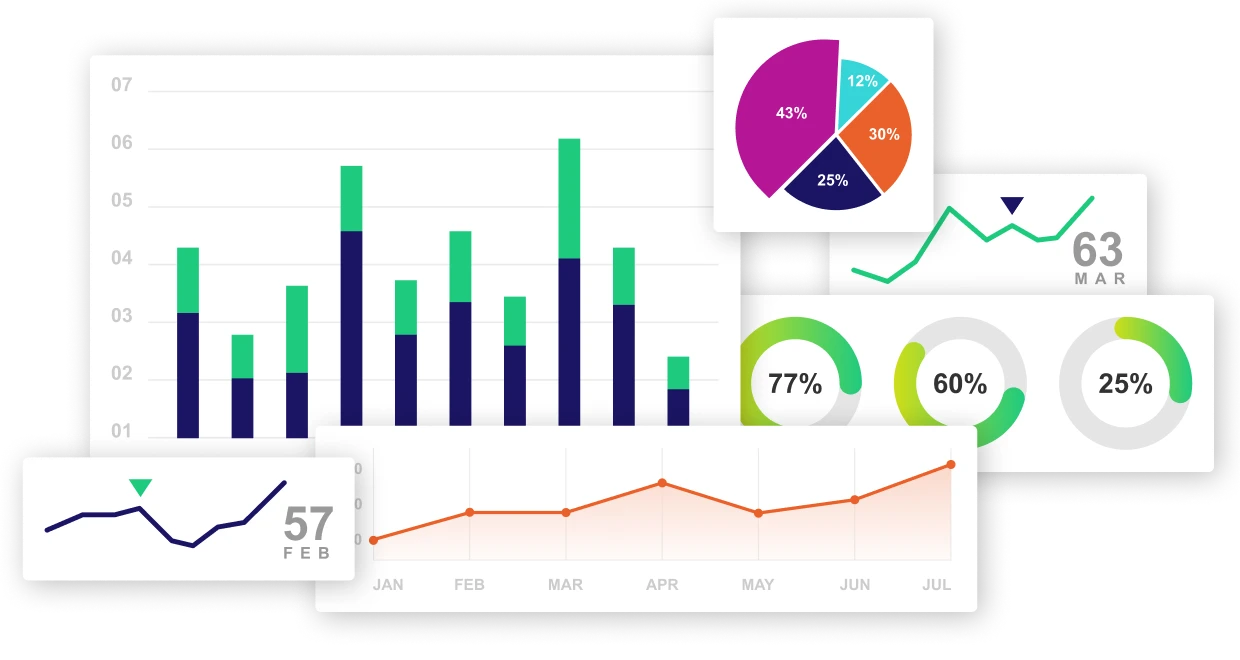

The Outseer 3-D Secure solution has a KPI dashboard with key metrics such as fraud detection rates, intervention rates, transaction volumes, and transaction value, allowing you to track ROI.

The Analytics application helps you analyze site traffic, transactions, business trends, and performance data. You can view and export performance data to gain an overview of the metrics, and drill down into the data, or highlight trends and exceptions.

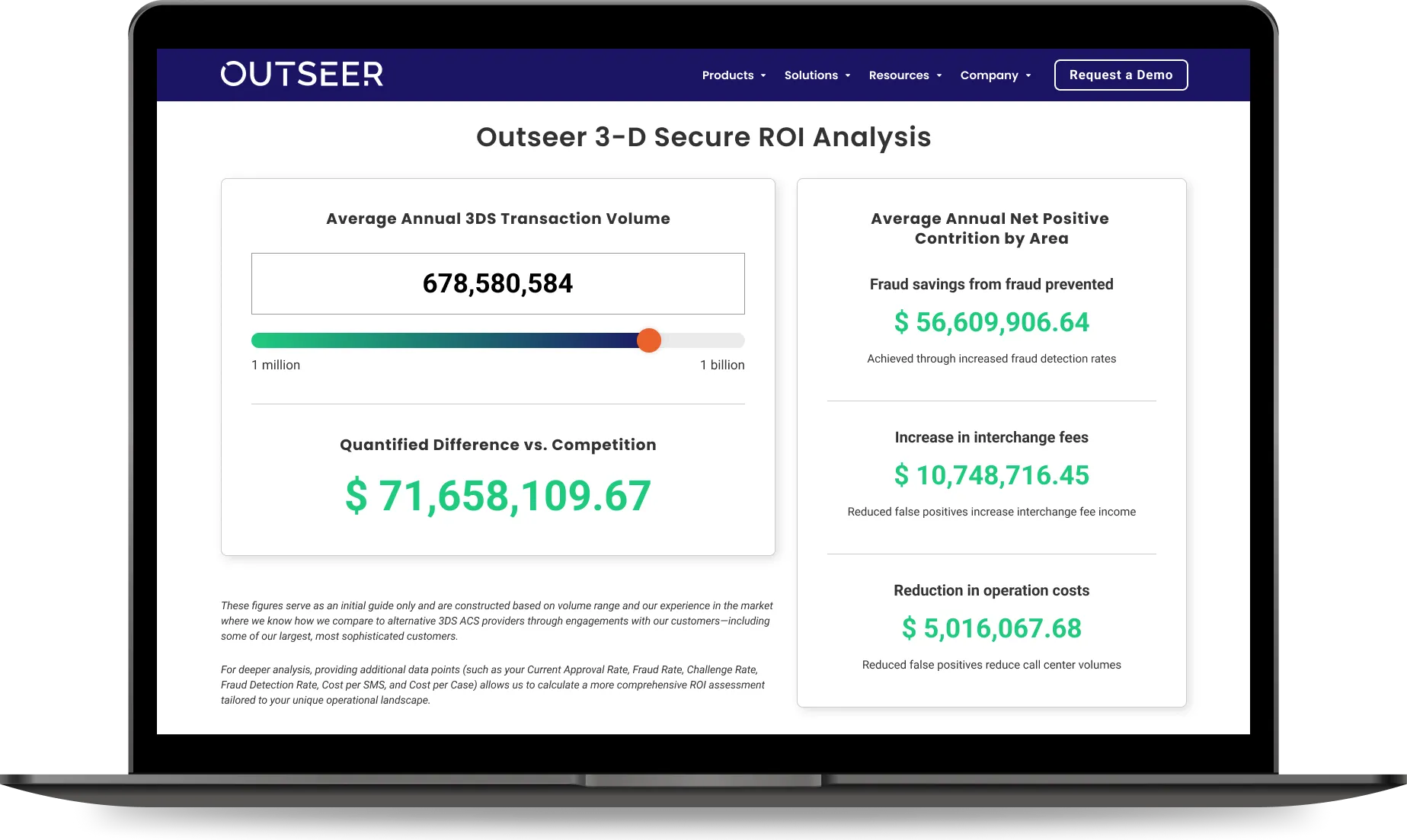

See where you can increase profits with our ROI calculator

Gain insight into hour much your financial institution could gain

Experience 3-D Secure for Yourself

Request a ConsultationStay compliant while preventing CNP fraud

The process begins when a customer initiates a digital commerce transaction, such as making an online purchase through an ecommerce merchant/website.

Our Risk Engine immediately analyzes the transaction data. It evaluates a comprehensive set of factors—including user behavior, device information, transactional patterns, geo-location, and data elements specific to the EMV 3-D Secure protocol. Leveraging unique consortium data signals from the Outseer Global Data Network, as well as first- and third-party signals, the Risk Engine orchestrates multiple signals and assesses the risk level of the transaction. Your customized rules and policies further refine this assessment. This allows each transaction to be categorized into one of three risk levels: Low Risk, High Risk, or Highest Risk.

Transactions categorized as low risk are typically fast-tracked, allowing customers to proceed without friction. These transactions are authenticated using the 3-D Secure protocol and proceed to completion, with the payment being processed and the order confirmed. The customer receives their purchase digital goods immediately.

Transactions that are flagged as high risk require additional verification to ensure legitimacy. Strong Customer Authentication (SCA), recommended for high-risk transactions, adds extra layers of security to electronic payments. This may involve steps such as entering a password, using biometrics, or receiving a one-time passcode (OTP). Once SCA is initiated and upon successful verification, transactions deemed trustworthy are authenticated and proceed to completion, with the payment processed and the order confirmed.

Transactions categorized as the highest risk are flagged for serious concerns that are likely fraudulent. These transactions are typically declined to prevent fraudulent activity.

The Outseer Risk Engine continuously monitors transaction patterns and updates its algorithms based on new data, ensuring ongoing optimization and robust fraud prevention for future transactions. This ensures a seamless shopping experience by quickly processing low-risk transactions while applying necessary security measures for higher-risk transactions, ultimately reducing fraud while enhancing the consumer experience.

Delivering value throughout your Outseer journey

Achieve optimal fraud detection while maintaining operational efficiency and enhancing customer experience with Outseer Value Added Services.