AI-powered account protection and payment fraud prevention

Protect every step of your customers' digital banking journey with a comprehensive fraud management platform that utilizes predictive AI along with a powerful policy engine to help prevent fraud and ensure a secure and streamlined digital banking journey.

Trusted by leading financial institutions around the world

Superior Fraud Management Performance

Outseer’s Fraud Manager platform uses unique consortium data from our Global Data Network while leveraging proven predictive AI-powered models resulting in industry-leading fraud prevention for more signal and less noise.

fraud detection rate with less than 5% false positives means reduced fraud losses and better customer experience

transaction value protected annually

transactions and digital interactions protected annually

Best-in-Class Fraud Prevention with Superior Data Science

A history of fraud prevention

Outseer Fraud Manager (formerly known as RSA Adaptive Authentication) is a comprehensive, market-leading transactional risk management platform powered by predictive AI and proprietary machine learning algorithms along with a robust policy engine to protect customer digital interactions.

Outseer Fraud Manager was the original risk-based authentication (RBA) solution that defined an industry in the fight against Account Takeover (ATO) in digital banking. Leveraging our 20-year history, Outseer continues to innovate, protecting digital transactions from ever-evolving fraud threats such as social engineering and APP scams.

Learn more about our newest innovation that incorporates Behavioral Biometrics natively into Fraud Manager.

Gain unmatched fraud prevention from superior data science

The Outseer Platform orchestrates data signals and authentication decisioning so you can leverage the right data signals and invoke the right authenticator for a given use case.

Orchestrate signals and decisioning with a comprehensive platform

The Outseer Platform orchestrates data signals and authentication decisioning so you can leverage the right data signals and invoke the right authenticator for a given use case.

Secure every stage of your customers’ digital banking journey

Outseer’s comprehensive digital banking fraud prevention solution can accurately assess risk at every stage of your customer’s digital banking journey. It continuously authenticates users at login, through account changes to one-time and recurring payments.

Optimize customer experience and operational efficiency through reduced false positives

Outseer’s superior fraud detection rates are accompanied by industry-low false positive rates. In turn, this enables a superior, more seamless customer experience and, since fewer false alerts need to be handled, there are more operational efficiencies.

A Set of Capabilities That Improve Efficiency and Put You in Control

Create informed rules based on orchestrated data signals and policies

Outseer Case Manager is a critical component of the Outseer Platform that helps you track, research, and manage potential fraud events according to the policies that are set within our Policy Manager. When a suspected fraudulent transaction occurs, a case is generated to provide details of the transaction for further investigation by fraud analysts. Knowledge gained through these investigations can inform the swift creation of new policies or updates to current policies in our Policy Manager.

Drill down to better understand and confirm fraud events

Outseer Case Manager is a critical component of the Outseer Platform that helps you track, research, and manage potential fraud events according to the policies that are set within our Policy Manager. When a suspected fraudulent transaction occurs, a case is generated to provide details of the transaction for further investigation by fraud analysts. Knowledge gained through these investigations can inform the swift creation of new policies or updates to current policies in our Policy Manager.

When cases reach final disposition, feedback is provided to the Outseer Risk Engine and Outseer Global Data Network, helping to enhance the predictive AI running at the heart of our Risk Engine.

Mitigating Fraud Across the Customer Journey

Outseer Fraud Manager is powered by the Outseer Platform. Within the Platform, the Outseer Global Data Network feeds superior consortium data into our AI-powered Outseer Risk Engine, which uses insights gained from billions of transactions to create a predictive risk score that accurately assesses the risk associated with each transaction and interaction during the user’s digital journey.

Outseer Platform

AI-powered fraud management platform

The Outseer Platform is a proven transactional risk management platform for financial institutions and card issuers that provides comprehensive fraud protection across the digital banking journey from login to payment, mitigating fraud threats including account takeover, consumer scams, and authorized push payment fraud. With better fraud detection and intelligent risk-based authentication, Outseer clients can deliver an exceptional digital banking experience to their customers with less operational cost.

With the Fraud Manager platform, you can:

- Access insights across authentication and payment transactions

- Enhance risk scoring by ingesting first- and third-party data signals

- Deliver consistent risk controls at all customer touchpoints

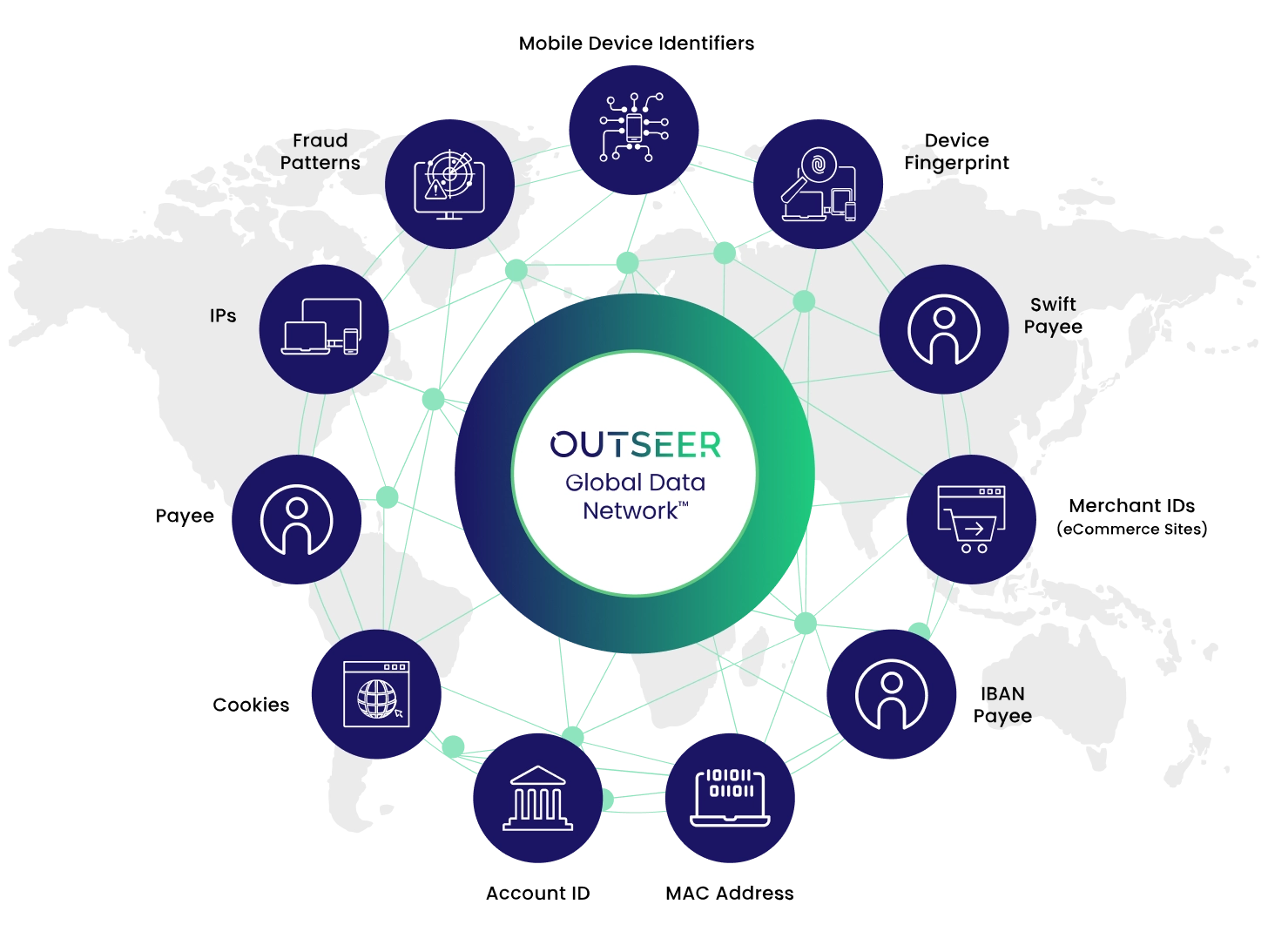

Global Data Network

More accurate fraud detection with fewer interventions from superior consortium data

The Outseer Global Data Network is a collaborative data consortium that aggregates signals from millions of transactions across thousands of the largest financial institutions in over 50 countries. With near real-time sharing of high-quality signals from confirmed fraud events, it provides determinative indicators into emerging threat patterns.

The Outseer Global Data Network includes data elements such as:

- Session Details

- Merchant IDs

- IP Address

- IBANs

- Device Fingerprint

- Email Address

Risk Engine with Normalized Scoring

Best-in-class risk engine and predictive AI models

The Outseer Risk Engine performs sub-second digital event risk scoring, using well-tuned predictive AI models trained on billions of transactions, and superior data from our Global Data Network. Our Risk Engine orchestrates and analyzes transaction data, consortium data signals from our Outseer Global Data Network, and first- and third-party signals to produce a highly accurate score. Importantly, this risk score is normalized to optimize intervention rates for your transaction volumes, so you only challenge customers when necessary and at a predictable rate.

Fraud Manager looks at signals such as:

- Device identification signals

- Location intelligence signals

- Confirmed fraud indications from Outseer’s Global Data Network

- First- and third-party signals

- Behavioral biometrics signals

- and more...

Learn and Adapt to Evolving Threats

Fraud Manager just works. It keeps pace with evolving threats as it learns and adapts. Authenticate customers and profile risk to protect against account takeover, scams, and payment fraud.

Elevate Your Fraud Defense:

Experience Fraud Manager for Yourself

Predictive Scoring for an Optimized Customer Experience

1) User Authenticates

The end user enrolls, logs into an application protected by Fraud Manager using their username and password, makes a payment, adds/edits a payee, or adds/edits their credentials.

2) Risk Indicators Are Evaluated

Fraud Manager profiles the user's activity, focusing on over 100 risk indicators contributed to the risk engine. These include device details, behavioral patterns, signals from the Global Data Network, and custom risk factors.

Device and Behavioral Analysis

Fraud Manager evaluates the device used for the current activity to determine its typicality for the user and checks if it has been associated with previous fraudulent activities. It also assesses current behavior against usual patterns to identify anomalies.

Global Data Network

Fraud Manager checks the current activity against known fraudulent data within the Outseer Global Data Network, a cross-industry fraud repository.

3) Risk Score Calculation

This information is processed by the Outseer engine to compute a risk score for this activity.

4) Policy Evaluation

The risk score is fed to the Outseer Policy Manager, which assesses if the activity violates any organization policies or rules and renders a risk-based decision.

Proceed as normal

If the user activity doesn’t show anything suspicious or violate any policies or rules, the user is transparently authenticated and continues with their user experience without interruption.

Deny transaction

If the user activity is suspicious or violates any policies or rules, the transaction is denied.

Additional authentication

If the risk exceeds the threshold set in the policy application, the system can prompt additional assurance or step up authentication, mark the transaction for review later in the case management application, and/or block the activity.

5) Step-Up Authentication

(If necessary)

Options could involve challenge questions, out-of-band authentication, dynamic knowledge-based authentication, or existing in-house methods. Once the step-up authentication is done, the transaction is either allowed or denied.

6) Case Manager & Analysis

(If necessary)

Failed Step-up Authentication attempts trigger a case in the Case Management application, which is evaluated by fraud analysts. Analysis results are fed back into the risk engine for continuous improvement.

Valuable Fraud Prevention Tools

Ready to get started?

Discover how easy it is to stop fraud before it happens and know that every transaction is as real as the happy customer behind it by giving your teams the tools to succeed. Explore Outseer's proven solutions today!