In the ever-evolving landscape of online payments, understanding the latest advancements in technology is crucial for businesses to stay competitive. Two of the latest include Click to Pay and FIDO authentication.

Click to Pay: Enhancing Customer Experience While Strengthening Fraud Prevention

Click to Pay represents a pivotal shift in online payment experiences, aiming to streamline and unify the often-fragmented journey consumers face when making purchases online. Developed by EMVCo, Click to Pay serves as a comprehensive interface that integrates various technologies, including EMV 3-D Secure (3DS) and tokenization, while also incorporating digital wallet functionality.

By implementing Click to Pay, financial institutions and card issuers can simplify payment processes, eliminating the need for separate integrations for payment, 3DS, and tokenization. The result? A smoother, more efficient checkout process for consumers, reduced operational complexities for businesses, and enhanced fraud prevention.

Click to Pay streamlines online shopping by enabling cardholders’ devices to be remembered for future purchases, eliminating the need for repetitive logins across various stores. Additionally, it facilitates the seamless addition of billing and shipping addresses to the secure digital wallet, sparing users from the hassle of manually entering these details during online transactions.

By replacing sensitive payment data, such as credit card numbers, with unique tokens, Click to Pay ensures that valuable information is shielded from prying eyes. Even if intercepted, these tokens are useless to fraudsters, as they cannot be used to initiate unauthorized transactions. Click to Pay leverages dynamic tokens, which change with each transaction, further thwarting fraudulent attempts to capture and misuse payment data. This layered approach to tokenization adds an extra layer of security, making it significantly more challenging for fraudsters to compromise sensitive information.

Click to Pay holds the potential to evolve online transactions and catalyze industry-wide adoption of tokenisation and FIDO for authentication. This is evidenced by the proactive steps taken by industry giants like Mastercard and Visa, who have embraced Click to Pay under their respective banners of Mastercard Click to Pay and Visa Checkout.

Notably, Mastercard has further solidified its commitment by expanding its Click to Pay implementation to the Australian market, signalling a significant stride towards global adoption.

FIDO: Elevating Authentication and Fortifying Fraud Prevention

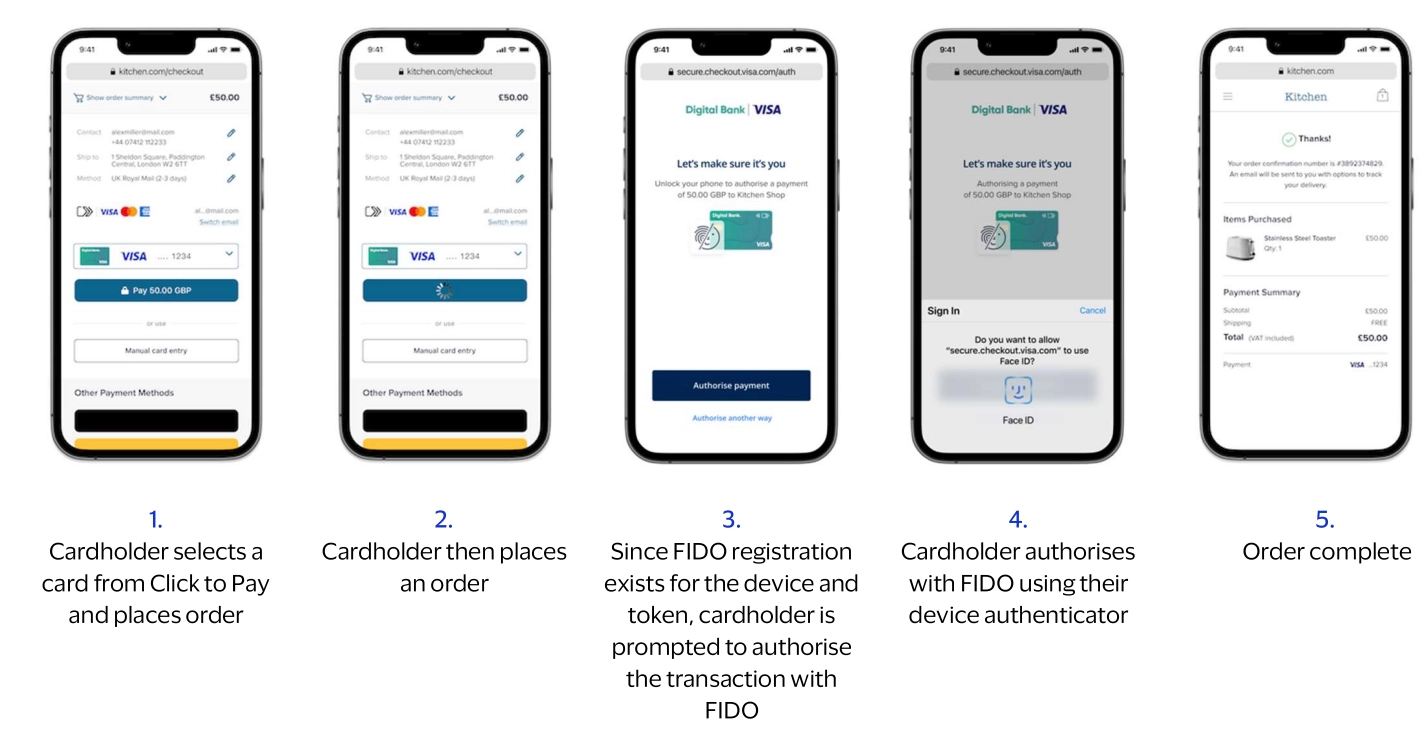

Authentication is a critical aspect of online transactions, ensuring the security and integrity of each purchase. FIDO (Fast Identity Online), a set of open standards designed to address the shortcomings of traditional password-based authentication methods. With FIDO, the goal is to deliver a frictionless and secure authentication experience across various devices and platforms. By leveraging cryptographic principles and biometric data, FIDO authentication minimizes reliance on passwords, reducing the risk of credential theft and enhancing user convenience.

Authentication is a critical aspect of online transactions, ensuring the security and integrity of each purchase. FIDO (Fast Identity Online), a set of open standards designed to address the shortcomings of traditional password-based authentication methods. With FIDO, the goal is to deliver a frictionless and secure authentication experience across various devices and platforms. By leveraging cryptographic principles and biometric data, FIDO authentication minimizes reliance on passwords, reducing the risk of credential theft and enhancing user convenience.

Visa is championing the adoption of FIDO authentication within the Click to Pay framework, recognizing its potential to further detect and prevent fraud, and streamline the checkout process. This commitment aligns with AI13373 mandate, which became effective as of 1 April 2024.

As a leader in fraud prevention, Outseer fully supports this initiative by supporting Visa FIDO ‘on behalf’ in our 3-D Secure platform, ensuring enhanced security and a frictionless payment experience for our customers.

Mastercard’s stance to extensively supporting FIDO remains to be seen, though it is making strides in adopting FIDO through it’s The Mastercard Biometric Authentication Service, which is based on the latest FIDO standards.

A Unified Payment Ecosystem

As businesses navigate the evolving landscape of online payments, the convergence of Click to Pay and FIDO authentication represents a significant step forward. By combining streamlined transaction processes with robust security measures, this unified approach promises to redefine the digital shopping experience.

The future of online payments is bright, driven by innovations that prioritize fraud prevention, efficiency, and user experience. By embracing technologies like Click to Pay and FIDO authentication, financial institutions can position themselves at the forefront of this journey, delivering seamless and secure online transactions.